Is this job too good to be true?

Imagine for a moment…

You’re checking your inbox, and a job offer pops up! Unlike the curated job listing emails from LinkedIn or Indeed, this one is unprompted and came directly from a recruiter. She says she ran across your profile and thinks you’re a great fit for a flexible, remote work opportunity with a growing company. How exciting! They’ll pay you $550/week just to complete a few simple tasks, but you need to reply quickly because this job opening is very popular.

It sounds like an easy side gig and having some extra cash would be nice, so you reply that you’re interested. She says all you need to do is fill out the job application – no awkward video interview required. Perfect! Then she asks, “Do you have an existing bank account where we can deposit your check?”

Uh oh... Looks like you’ve been lured into a Work-From-Home scam!

What is a Work-From-Home (WFH) Scam?

WFH Scams are fake job offers that result in compromised personal data and money loss. Since remote work has become more common and is growing in popularity, scammers are taking advantage of the trend. According to the FTC, reports of “job opportunity” scams doubled from 2020 to 2024, and monetary losses more than tripled. The average amount lost was $2,270, resulting in total losses of more than $764 million in 2024.

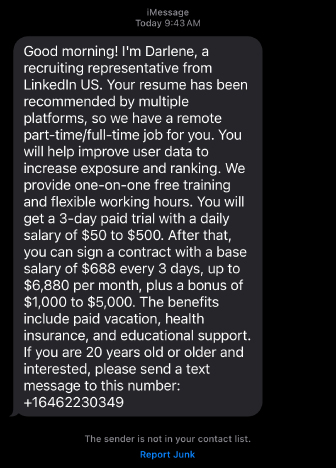

In fact, these scams are so popular that while I was writing this article, I received an offer via text! Check it out.

Like all scams, there are warning signs.

Outsmart the scammers by spotting these red flags:

- Unexpected or Unusual Contact

If you haven’t done anything to prompt an email, text, or phone call from this company, be skeptical. Do not give anyone your personal or financial information without verifying that they work for a company you trust and have a legitimate reason for the request.

- High Pay for Minimal Effort

A scammer may offer generous pay for completing odd tasks like “using a new app” or “purchasing items,” according to their instructions. Trust your intuition. If it sounds vague or too good to be true, it usually is.

- Pressure to Act Fast

Scammers often create a false sense of urgency to prevent you from thinking things through and consulting others. Slow down. Talk to your friends and family before acting on any offers.

- Rationalizing Odd Requests

Scammers often have manipulative excuses for their unusual requests to discourage us from asking too many questions. They might claim they can’t meet in person because they’re caring for a sick relative, the interview must be text-only because they have a bad internet connection, or they need you to pay them a fee for training, software, or equipment before you can get started. If the request doesn’t feel right, challenge it.

- Unprofessional or Awkward Communication Style

Although scammers may use AI tools like ChatGPT to create more convincing messages, it’s important to remain cautious if an email or text contains poor grammar, strange formatting, or an overly casual tone. People make mistakes, so you may feel compelled to give others the benefit of the doubt, but beware… freqent typos are clasic red flags.

- Lack of Supporting Information Online

Whether you have or haven’t heard of this company before, do a little extra research. Go to Google (or your preferred search engine) and search for the company’s website. Check their job postings, look for employee reviews, and check their social media accounts for activity. Contact them directly using published phone numbers, ask about the position, and verify that your contact person works for the company. You can even search for the contact person’s name and the phone number or email they’re using to communicate with you. If it’s a common scam, you may discover reports from others who have experienced it too.

Ok, so you fell for it. Now what?

If you think you’ve fallen for a WFH scam, here’s what to do:

- Don’t Panic. Don’t Sulk. Just Take Action. It may feel embarrassing to find out you’ve been duped by a scammer. Unfortunately, it’s a very common experience. Now is not the time to be hard on yourself. It’s time to act fast and start damage control.

- Stop All Communication with the scammer. Don’t fight with them or tell them you figured it out. Just end it.

- Report the Scam to the Federal Trade Commission (FTC) at reportfraud.ftc.gov.

- Contact Your Financial Institution if you sent money or gave them your account information. There may still be time to reverse the transaction or shut down the account.

- Change Your Passwords if you shared any login information.

- Monitor Your Credit and consider placing a fraud alert or credit freeze.

Want to keep reading about these scams?

Here are articles about different types of WFH scams that have been reported.

- Job scam warning for new graduates | WDSU

- Online job scams offer remote work, unrealistic wages | USA Today

- Biggest Scams to Watch for in 2025 | AARP

- Scammers impersonate well-known companies | FTC

- Task scams create the illusion of making money | FTC

Here are a couple of real-life examples from real companies:

We're here to enhance your financial well-being.

If you have a financial topic you'd like us to explore, fill out our .